Our employee benefits are an important part of the total compensation package received by our employees. Peak Vista pays a portion of the medical and dental premiums for employees and their spouse/dependents. The following is a summary of the benefits offered at Peak Vista:

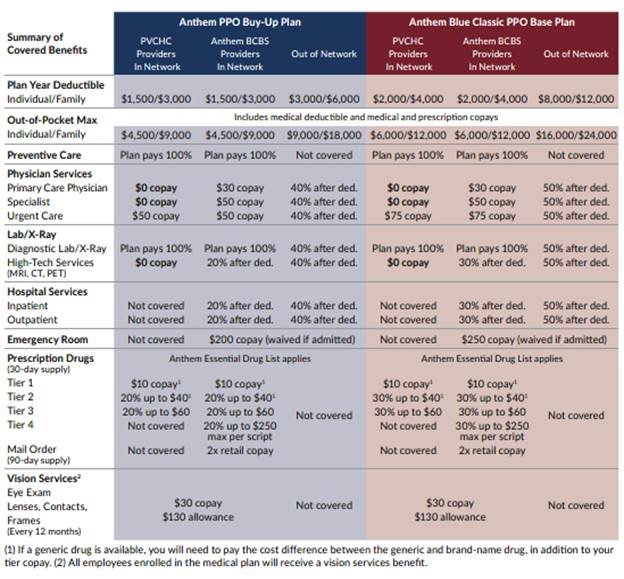

PVCHC offers three medical plan options through Anthem BlueCross BlueShield: the PPO base plan, the PPO buy-up plan, and the HSA-compatible high-deductible health plan (HDHP).

PVCHC offers a dental insurance plan through Delta Dental of Colorado.

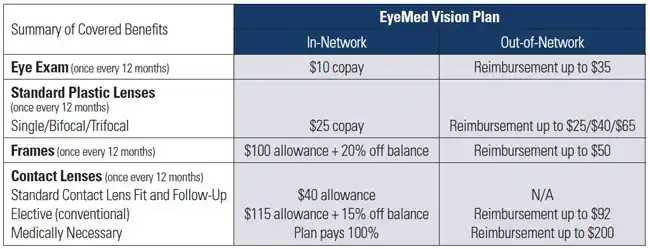

PVCHC offers a voluntary vision insurance plan through EyeMed. This plan is 100% employee paid.

PVCHC sponsors a 403(b) retirement savings plan that allows employees to save for retirement on a pre-tax (traditional) and/or after-tax (Roth) basis. The plan also provides an employer match after the employee completes one year of service. The match is equal to 100% of the employee’s contribution, up to four 4%, and is immediately 100% vested to the employee. All employees are eligible to participate on their date of hire.

PVCHC provides PTO for eligible employees that can be used for vacation, personal leave, illness, etc. An employee's accrual is based on hours worked.

PVCHC provides holiday pay to eligible employees based on their full-time equivalent (FTE) status. Paid holidays include New Year's Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day (and the day after), Christmas Eve (closed at noon), Christmas Day, New Year's Eve, and one floating holiday.

PVCHC also offers other leave benefits including Personal Leave of Absence, Jury Duty, Bereavement, FMLA, Military Leave, etc.

Term life and AD&D insurance of 1.5 times an employee’s annual compensation, up to $200,000. PVCHC pays 100% of the cost of coverage.

LTD covers 60% of an employee’s monthly compensation, up to $7,500, if an employee has a qualifying disability lasting longer than 90 days. PVCHC pays 100% of the cost of coverage.

The Ability Assistance Program offers personal, confidential guidance and counseling for employees and their dependents at no cost.

If you enroll in the PVCHC high-deductible health (HDHP) plan, you may be eligible to open and fund a health savings account(HSA). As HSA is a personal healthcare savings account that you can use to pay out-of-pocket healthcare expenses with pre-tax dollars. Your contributions are tax free, and the month remains in the account for you to spend on eligible expenses no matter where you work or how long it stays in the account.

FSA plans allow employees to save for qualified health and/or dependent care expenses for themselves and/or their spouse and dependents.

Eligible employees may apply for voluntary supplemental insurance (group term life, accident, critical illness, and short-term disability) for themselves and/or their spouse and dependents.

PVCHC offers other benefits including a wellness program, prepaid legal services, health education classes, tuition reimbursement, and employee discount programs.

This Benefits Guide is intended only to provide you with highlights of benefit plans and programs, and is subject to change. In the event of an error in this or any other communication, your rights will always be determined under the provision of the applicable plan document (and the plan’s administrative rules). This Guide is not intended to provide any personalized advice, including tax, legal and/or medical advice. For further information, you may wish to consult trusted, reputable advisors.